If you missed out on buying Game Stop stock before it exploded don’t fret. There is still time for you to make money by refinancing your loan.

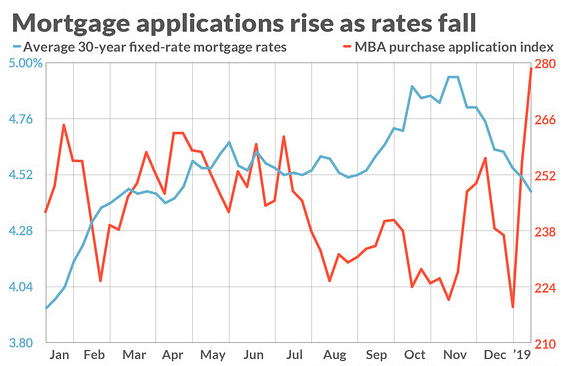

While Game Stop stock is dropping, interest rates have remained low. 2020 was a banner year for refinancing as rates for 30 year fixed were under 3%.Imagine locking in a rate at 2.25% on a 15-year fixed or 2.675% on a 30-year fixed.

What’s also amazing is that lenders are starting to find creative ways to help more clients.

In 2020 ALT A programs returned and clients could obtain low rates with the bank statement program. This innovative approach is where the lender took an average of your bank deposits for the last 12 months and treated that as your income. This is an exciting way for self-employed or seasonal borrowers to still qualify for a loan. Let’s say you work on commission, or in the movie industry and you got big paychecks in February, April and August but the rest of the year the income was low. The lender would average your deposits and then divide by 12 to come up with a monthly amount of your income.

In 2021 the news gets better. We now have a new lender who is offering a true No Income qualifying loan. Rates vary around 5-6% depending on the LTV and credit. While these rates are higher they still are amazingly low considering the previous alternative was hard money loans. We also have a lender that offers 2nd TD or Heloc loans to both owner occupied and Non-Owner homes.On New purchases we have lenders who will now finance up to 97% of the home.

Also, In 2021 FHFA expanded their conforming loan amounts and increased them to $548,250 and high balance up to $822,375. Only 3 years ago these amounts were at $417K/625K. This means that more borrowers with higher balances can qualify for the best possible rates. Finally, if you’ve been on forbearance or are receiving unemployment income due to Covid19 there is still options to help qualify and take advantage of these lower rates. We hope that you are surviving this pandemic. With nearly 500,000 deaths we know that everyone has been effected by this virus. Please stay safe, socially distance and wear a mask.

To disucss your confidential scenario please CLICK HERE to send an appointment or email

Mitch Lichterman

Vice President-Broker

www.WallStreetFundingOfAmerica.com

Mitch@wallstreetfundingofamerica.com

310-478-4999 Direct

310-529-4944 Cell

310-893-6462 Fax

mitch.lichterman Skype